NZ Pet Insurance Comparison

Table of Contents

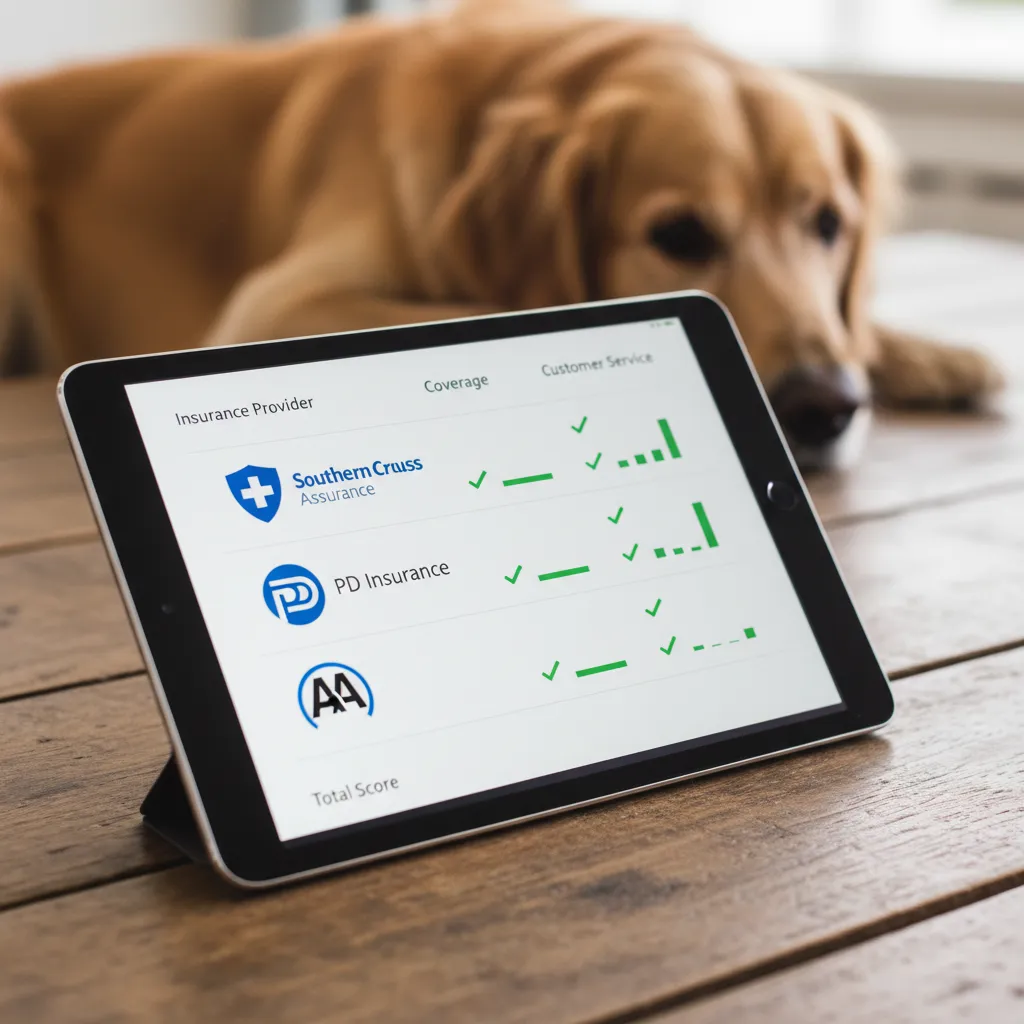

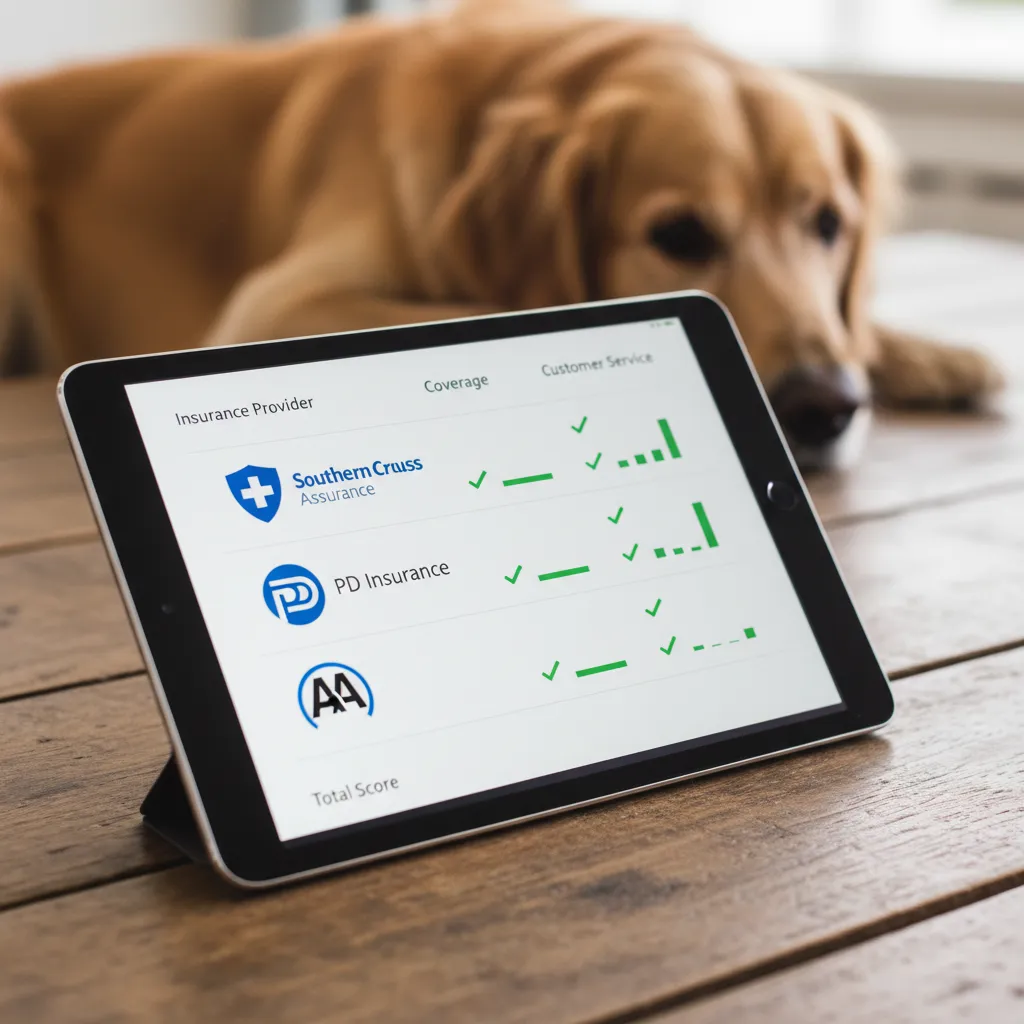

The best pet insurance in NZ is a policy that balances affordable premiums with high annual coverage limits, offering comprehensive protection for both accidents and illnesses. Top-rated providers like Southern Cross, PD Insurance, and AA distinguish themselves through transparent co-pay structures, coverage for hereditary conditions, and flexible excess options that suit different budgets.

For many New Zealanders, pets are not just animals; they are integral members of the family. Whether you have a Golden Retriever loving the beaches of the North Shore or a tabby cat navigating the suburbs of Christchurch, the bond is undeniable. However, advancements in veterinary medicine have led to a significant rise in the cost of animal healthcare. Procedures that were once rare, such as MRI scans, chemotherapy, and complex orthopedic surgeries, are now commonplace in Kiwi vet clinics, but they come with a hefty price tag.

Navigating the landscape of New Zealand pet insurance can be daunting. For those considering pet ownership from abroad, understanding Importing Pets to NZ: MPI Standards is an essential prerequisite. With various underwriters, differing definitions of “pre-existing conditions,” and a myriad of exclusion clauses, finding the right cover requires a commercial investigation into the fine print. This guide serves as the definitive resource for comparing the best pet insurance options in NZ, ensuring your furry friend gets the care they need without breaking the bank.

Understanding Pet Insurance in New Zealand

Before diving into specific providers, it is crucial to understand the fundamental structure of pet insurance in the New Zealand market. Unlike human health care, which is heavily subsidized by the government, veterinary care is a private industry. Pet insurance operates on a reimbursement model. You pay the vet bill upfront, and the insurer reimburses you a percentage of the eligible costs, minus your excess (deductible).

Most policies in NZ fall into three main categories:

- Accident Only: The most basic and affordable tier. It covers injuries resulting from accidents, such as being hit by a car, snake bites (rare in NZ, but insect stings apply), or bone fractures. It does not cover illnesses like cancer or diabetes.

- Accident and Illness: The most popular choice. This covers accidents as well as sicknesses, infections, and chronic conditions.

- Comprehensive/Premium: These plans often include higher annual limits, lower co-pays, and extras like dental maintenance, vaccinations, or boarding fees if the owner is hospitalized.

It is important to note that New Zealand has specific regulatory bodies ensuring fair trading. For reliable consumer advice, organizations like Consumer NZ provide independent assessments of service providers, which can be a valuable resource when vetting insurance companies.

Top Contenders: Southern Cross vs PD Insurance vs AA Pet Insurance

When searching for the “best pet insurance NZ,” three names frequently dominate the conversation: Southern Cross Pet Insurance, PD Insurance, and AA Pet Insurance. Each has distinct strengths and target demographics.

Southern Cross Pet Insurance

As a household name in human healthcare, Southern Cross brings a reputation for stability and trust. Their pet insurance arm is one of the longest-standing in the country.

- Pros: They offer a “PetCare” plan that is widely regarded for its inclusiveness. Southern Cross often covers genetic and hereditary conditions, provided they were not present before the policy started. They also offer a multi-pet discount, which is beneficial for households with more than one animal.

- Cons: Premiums can be higher compared to newer market entrants. There is also a co-pay (percentage of the bill you pay) that increases as the pet ages, which is standard but can become expensive for senior pets.

PD Insurance

PD Insurance is a newer, agile player in the NZ market known for its “month-to-month” flexibility and aggressive pricing strategies.

- Pros: They are known for their “soft lock” contracts, meaning you aren’t tied into 12-month rigid contracts in the same way. They offer three clear tiers: Accident, Classic, and Deluxe. Their waiting periods are generally competitive, and they often run “first month free” promotions which reduce the barrier to entry.

- Cons: While their premiums are competitive, you must scrutinize the sub-limits on specific treatments (e.g., consultation fees or cruciate ligament surgery limits) to ensure they meet your expectations.

AA Pet Insurance

Backed by the New Zealand Automobile Association, AA Pet Insurance leverages its massive member base to offer integrated discounts.

- Pros: If you are already an AA Member, the discounts available make this a very attractive financial option. Their policies are underwritten by robust financial institutions, providing security. They offer a range of excess options allowing you to lower your premium by agreeing to pay more upfront during a claim.

- Cons: Non-members do not get the same pricing advantages. Their policy wording regarding dental coverage can be stricter than premium dedicated providers, so reading the Policy Disclosure Statement (PDS) is essential.

What Is Covered: Accident vs Illness

The distinction between accident and illness coverage is the most common source of friction during the claims process. Clarity here is paramount for pet owners.

Accident Coverage

Accident coverage is binary; an event either happened, or it didn’t. This includes:

- Motor vehicle incidents.

- Ingestion of foreign objects (a common issue for Labradors and puppies).

- Lacerations, burns, and fractures.

- Allergic reactions to insect bites.

Accident-only policies are significantly cheaper because the risk is actuarially lower than illness risks. They are ideal for young, healthy pets where the owner is willing to self-insure for potential illnesses later in life.

Illness Coverage

Illness coverage is where the value of pet insurance truly shines. Veterinary medicine now treats complex conditions that previously led to euthanasia. Illness coverage typically includes:

- Infectious Diseases: Parvovirus, kennel cough, etc.

- Chronic Conditions: Diabetes, arthritis, and allergies.

- Cancer: Chemotherapy and radiation are available in NZ but cost thousands.

- Surgical Conditions: Gastric torsion (bloat), cruciate ligament rupture, and cataracts.

Crucially, dental coverage is often a separate add-on or a sub-limit. Routine dental cleaning is rarely covered, but dental illness (like gingivitis requiring extraction) might be covered under premium plans. Always check the fine print regarding the New Zealand Veterinary Association guidelines on dental care standards.

The Pre-existing Conditions Clause: What You Need to Know

The “pre-existing condition” clause is the single most important paragraph in any pet insurance contract. In New Zealand, no pet insurance provider covers pre-existing conditions at the start of a new policy. However, the definition of “pre-existing” can vary slightly.

Generally, a pre-existing condition is defined as any ailment, injury, or symptom that:

- Was diagnosed by a vet before the policy start date.

- Showed clinical signs or symptoms before the policy start date, even if not yet diagnosed.

- Occurred during the applicable waiting period (usually 21 days for illness).

The “Temporary” Pre-existing Condition

Some insurers distinguish between chronic pre-existing conditions (like arthritis) and temporary ones (like a broken leg or an ear infection). If a pet had an ear infection two years ago, was treated, and has been symptom-free for a set period (often 12 to 24 months), some top-tier insurers may review the exclusion and agree to cover that condition moving forward. This is a critical feature to look for if you are insuring an older pet.

Bilateral Conditions

Be wary of bilateral exclusions. This refers to body parts that come in pairs, such as eyes, ears, or knees (cruciate ligaments). If your dog tore their left cruciate ligament before getting insurance, the insurer will likely exclude the right cruciate ligament from coverage as well, assuming a high probability of failure in the opposing limb.

Cost Benefit Analysis: Is Pet Insurance Worth It in NZ?

Determining if pet insurance is “worth it” requires a cold, hard look at the numbers. The alternative to insurance is “self-insurance,” where you deposit a set amount into a savings account every month.

The Math of Veterinary Costs

Let’s look at common costs in New Zealand veterinary clinics (estimated):

- After-hours emergency consult: $150 – $300

- Snake/Insect bite treatment: $500 – $1,500

- Cruciate Ligament Surgery (TPLO): $3,500 – $6,000 per knee

- Cancer Treatment (Chemo/Surgery): $5,000 – $15,000+

If you pay a premium of $60 per month ($720 per year) and your pet remains healthy for five years, you have paid $3,600. If, in year six, your dog requires a $5,000 knee surgery, the insurance has effectively paid for itself, provided you have a low excess.

However, the true value lies in emotional protection. The hardest decision a pet owner ever has to make is “economic euthanasia”—putting a beloved pet to sleep because the treatment costs $10,000 and the family simply does not have the cash. Insurance removes the financial cap from medical decisions, allowing you to choose the best treatment for your pet, not just the cheapest. It’s one aspect of responsible pet ownership, alongside considering resources like Understanding Home-to-Home Pet Rehoming when circumstances change.

How to Choose the Best Policy for Your Pet

To select the best pet insurance in NZ, follow this checklist:

- Assess Your Breed’s Risks: If you own a German Shepherd, you need high coverage for hip dysplasia. If you own a Pug, you need coverage for respiratory issues. Ensure the policy does not have breed-specific exclusions.

- Check the Co-Pay Structure: Some policies pay 100% of the bill minus a fixed excess (e.g., $150). Others pay 80% of the bill. For a $10,000 bill, an 80% payout leaves you with a $2,000 gap. Know what you can afford.

- Review Annual Limits: A policy with a $5,000 annual limit is insufficient for major trauma or cancer. Look for policies with at least $10,000 to $15,000 in annual coverage.

- Read the PDS for “Sub-limits”: Some insurers limit how much they will pay for consultation fees or specific surgeries. Avoid policies with low sub-limits on common high-cost surgeries.

- Start Young: The best time to insure a pet is as a puppy or kitten. This avoids the pre-existing condition trap and locks in coverage before age-related issues begin. For more comprehensive advice, new owners should consult Essential Guidance for New Owners in New Zealand.

In conclusion, while the monthly premiums can seem like an added expense in a high-cost-of-living environment, the financial safety net provided by comprehensive pet insurance is invaluable. By comparing Southern Cross, PD, and AA, and understanding the nuances of coverage, you can secure a policy that ensures your pet lives a long, healthy, and happy life.

Frequently Asked Questions

Does pet insurance in NZ cover vaccinations?

Most standard accident and illness policies do not cover routine care like vaccinations, flea treatments, or worming. However, providers like Southern Cross and PD Insurance often offer “Wellness” or “Routine Care” add-ons that can contribute towards these costs, though the payout is usually capped.

What is the average cost of pet insurance in New Zealand?

The cost varies significantly based on breed, age, and location. On average, you might expect to pay between $30 and $60 per month for a cat, and between $40 and $90 per month for a dog. Premium breeds or older pets will attract higher premiums.

Can I get pet insurance if my pet is already sick?

You can get insurance, but the specific illness your pet currently has will be considered a “pre-existing condition” and will be excluded from coverage. The policy will still cover new, unrelated accidents or illnesses that occur after the waiting period.

Is dental covered by pet insurance in NZ?

Basic policies usually exclude dental. Comprehensive policies may cover dental illness (e.g., abscesses or gingivitis requiring extraction) but typically exclude routine scaling and polishing. Always check the Policy Disclosure Statement for dental sub-limits.

Does pet insurance cover theft or straying?

Some premium pet insurance policies in NZ include a benefit for advertising costs or a reward if your pet is lost or stolen. Some may even pay the purchase price of the pet if they are not found within a certain timeframe, but this is less common in basic plans.

Are there waiting periods for pet insurance?

Yes. Almost all policies have a waiting period to prevent fraud. This is typically 24-48 hours for accidents and 21-30 days for illnesses. Cruciate ligament conditions often have a longer waiting period, sometimes up to 6 months.