Landlord Insurance for Pet Damage

Table of Contents

- The Landscape of Landlord Insurance for Pets in NZ

- Top Insurance Providers and Their Coverage Models

- The Critical Distinction: Intentional vs. Accidental Damage

- Policy Limits, Exclusions, and the “Gradual” Trap

- Tenant Advocacy: How to Pitch Pet-Friendly Tenancies

- The Role of Tenant Liability Insurance

- Final Thoughts for Landlords and Tenants

Landlord insurance for pets in NZ is a specialized coverage option or policy extension designed to protect property owners financially against damage caused by a tenant’s domestic animals. Unlike standard policies which often exclude animal-related destruction, these comprehensive plans cover costs associated with accidental damage, such as carpet soiling or scratching, providing a vital safety net in a rental market where traditional pet bonds are legally prohibited.

The Landscape of Landlord Insurance for Pets in NZ

New Zealand is undeniably a nation of animal lovers, with statistics consistently showing that nearly two-thirds of Kiwi households own at least one pet. However, the rental market often struggles to reflect this demographic reality. For landlords, the hesitation to allow pets usually stems from a fear of property damage and the financial inability to recover costs effectively. For tenants, finding a “pet-friendly” rental can feel like searching for a needle in a haystack.

The urgency for specific landlord insurance for pets NZ has escalated due to changes in the Residential Tenancies Act (RTA). One of the most significant hurdles for New Zealand landlords is the inability to charge a “pet bond.” Unlike in other jurisdictions where landlords can hold an extra deposit specifically for pet damage, NZ law limits the bond to a maximum of four weeks’ rent, regardless of whether a Great Dane or a goldfish lives on the premises.

Furthermore, the shift in liability laws means tenants are generally only liable for the lesser of the insurance excess or four weeks’ rent for careless damage. This legislative environment makes specialized insurance not just a luxury, but a critical risk management tool for any property investor considering opening their doors to furry tenants.

Top Insurance Providers and Their Coverage Models

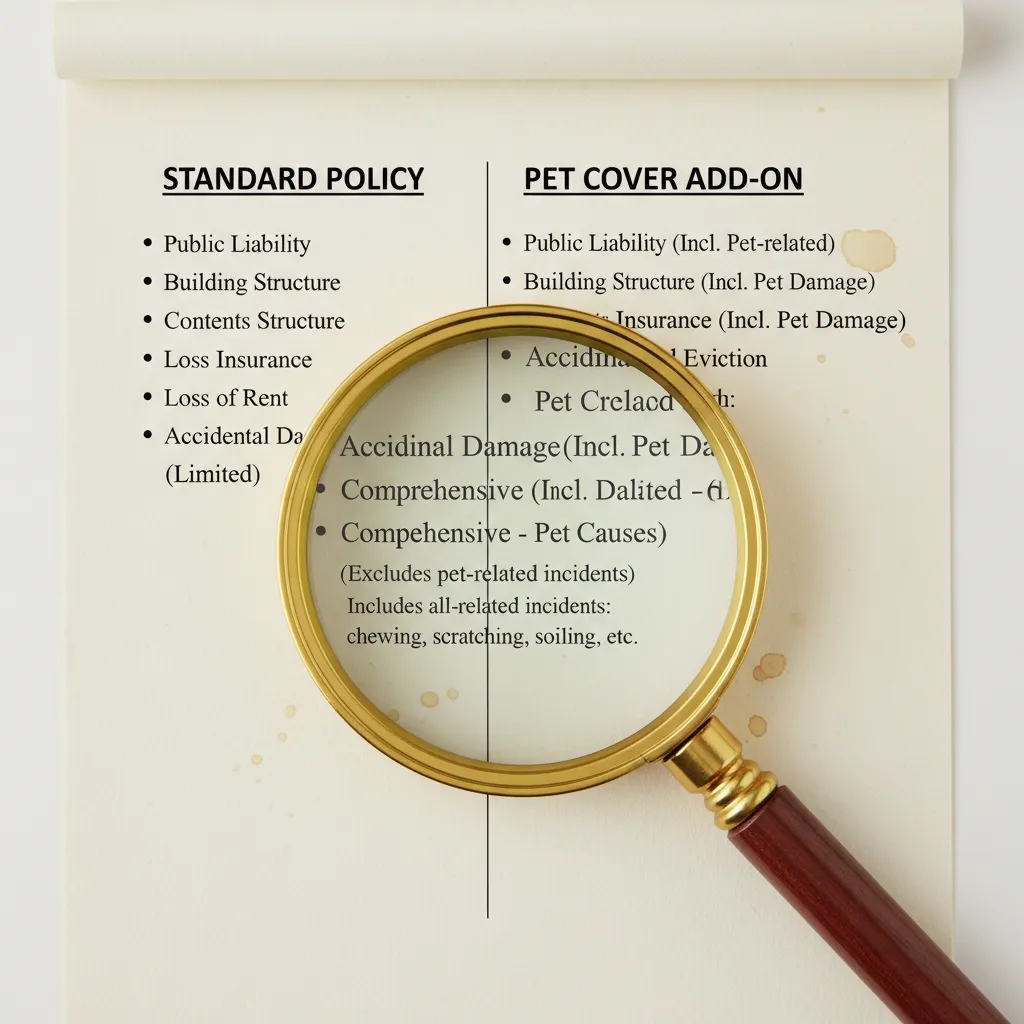

Not all insurance policies are created equal. In New Zealand, standard landlord insurance often contains specific exclusions for damage caused by animals belonging to the tenant. To ensure you are protected, you must look for policies that explicitly state coverage for pet damage or offer it as an optional add-on.

AMI Insurance

AMI is a prominent player in the NZ market and offers varying levels of landlord coverage. Their Premier policy is often cited for its inclusion of tenant damage. However, it is crucial to read the fine print regarding “contamination” versus physical breakage. AMI typically requires landlords to conduct regular inspections (usually every three months) to maintain the validity of the claim coverage.

Tower Insurance

Tower provides comprehensive landlord packages that can cover sudden and accidental damage caused by tenants or their guests—and this extends to pets in specific scenarios. Tower has been proactive in clarifying what constitutes “accidental” damage. Their policies often highlight coverage for loss of rent if the property becomes uninhabitable due to damage, which is a key consideration if a pet causes significant destruction requiring major repairs.

State Insurance

State’s landlord policy is another popular choice. They distinguish between malicious damage and accidental damage. While malicious damage by a tenant is covered up to a certain limit (often $25,000), pet damage usually falls under the accidental umbrella. It is vital to check if there is a sub-limit specifically for animal damage, as some policies cap this at a lower amount than general tenant damage.

Real Landlord Insurance (RLI)

RLI is a specialist provider often recommended by property management companies. Because they specialize solely in landlord insurance, their wording is often more attuned to the realities of tenancy risks, including pet ownership. They often offer broader coverage for “loss of rent” associated with eviction or property remediation caused by pets.

The Critical Distinction: Intentional vs. Accidental Damage

When filing a claim for landlord insurance pets NZ, the success of the claim often hinges on one word: intention. Insurance generally covers sudden, unforeseen, and accidental events. It does not cover wear and tear or gradual deterioration.

Defining Accidental Damage

Accidental damage is a specific event that happens unexpectedly. For example, if a tenant’s dog runs through a glass sliding door, that is an accident. If a cat knocks over a television, that is an accident. Most comprehensive landlord policies will cover these events, subject to the excess.

The Grey Area of “Intentional” Damage

In the context of pets, “intentional” is rarely applied to the animal (animals lack legal intent), but rather to the tenant’s negligence. However, insurers often view recurring behavior as non-accidental. If a dog scratches the back door every day for six months to be let out, resulting in the wood being gouged away, an insurer may argue this is not “sudden and accidental” but rather a behavioral pattern that the tenant failed to prevent. This is often categorized as wear and tear or gradual damage, leading to a declined claim.

According to Tenancy Services NZ, tenants are responsible for their actions and those of their pets, but landlords must prove that the damage was not fair wear and tear. This legal distinction is why insurance definitions are so vital.

Policy Limits, Exclusions, and the “Gradual” Trap

Even the best policy has limits. Understanding these exclusions is essential for both landlords and tenants to avoid financial shock.

The “Gradual Damage” Loophole

This is the most common reason for claim denial regarding pets. Urine stains on carpet are the prime example. If a puppy has a single accident that is immediately cleaned but leaves a stain, it might be covered. However, if a pet urinates in the same corner repeatedly over months, rotting the underlay and floorboards, insurers will classify this as “gradual damage.” Most policies strictly exclude gradual damage caused by hygiene issues or lack of maintenance.

Unapproved Pets

Insurance contracts are based on good faith. If a tenancy agreement states “No Pets,” but the landlord verbally agrees to a dog without updating the lease, the insurance might be void. Conversely, if a tenant hides a pet, the landlord is usually still covered for the damage, provided they can prove they inspected the property regularly and were unaware of the animal. However, if the landlord knew and did nothing, the insurer may deny the claim.

Excess Structures

Landlords should be aware of the excess (deductible) structure. Some policies apply a standard excess (e.g., $400) per event. If a dog chews three different door frames in three different rooms, an insurer might treat these as three separate events, effectively tripling the excess payable.

Tenant Advocacy: How to Pitch Pet-Friendly Tenancies

For tenants, the lack of pet-friendly housing is a crisis. However, understanding how landlord insurance works allows tenants to pitch themselves as lower-risk candidates. By addressing the landlord’s fears directly, tenants can negotiate effectively.

The Pet CV

- References: Contact details from previous landlords specifically vouching for the pet’s behavior.

- Vaccination and Desexing Records: Proves responsible ownership.

- Training Certificates: Evidence of obedience training reduces the fear of behavioral damage.

- Photos: A cute photo helps humanize the animal.

Negotiating the Rent to Cover Premiums

Since pet bonds are illegal in NZ, tenants cannot offer a lump sum for risk mitigation. However, tenants can acknowledge that a pet-friendly policy might cost the landlord slightly more in premiums. Tenants might offer a slightly higher weekly rent (e.g., $5-$10 extra) to offset the cost of the landlord upgrading their insurance policy to a comprehensive tier that includes pet damage. This is a legal negotiation of rent price, unlike a bond.

The Role of Tenant Liability Insurance

It is a misconception that only landlords need insurance. Tenants should carry their own Contents Insurance that includes personal liability.

While the landlord’s insurance covers the structure, the insurer may seek to recover costs from the tenant if the damage was due to negligence. However, recent changes to the Residential Tenancies Act limit a tenant’s liability to the landlord’s insurance excess or four weeks’ rent, whichever is lower.

Crucially, many tenant contents policies include liability cover for damage to the landlord’s property. This creates a double layer of safety. If a tenant’s dog causes accidental damage, the tenant can lodge a claim with their own insurer to pay the landlord’s excess or the reparation costs. This demonstrates to a landlord that the tenant is financially responsible and prepared.

For authoritative information on liability caps, refer to the Citizens Advice Bureau (CAB), which details the specific financial limits tenants face regarding accidental damage.

Final Thoughts for Landlords and Tenants

Navigating landlord insurance for pets in NZ requires a shift in mindset from both parties. For landlords, insurance is the mechanism that unlocks a massive pool of stable, long-term tenants who are often desperate for a home and willing to pay premium rents. For tenants, understanding the limitations of these policies allows for better advocacy and responsible behavior.

The key takeaway is documentation. Landlords must document inspections to validate claims, and tenants must document the condition of the property to protect against unfair accusations. With the right comprehensive policy, the risk of pet damage transforms from a potential financial disaster into a manageable, insured event.

People Also Ask

Does standard landlord insurance cover pet damage in NZ?

Does standard landlord insurance cover pet damage in NZ?

Not always. Basic landlord policies often exclude damage caused by domestic pets. You typically need to purchase a comprehensive policy or a specific “landlord extension” from providers like AMI, Tower, or State to ensure accidental pet damage is covered.

Can landlords charge a pet bond in New Zealand?

Can landlords charge a pet bond in New Zealand?

No. Under the Residential Tenancies Act, landlords cannot charge a bond exceeding four weeks’ rent. Charging an additional “pet bond” on top of the maximum bond is illegal. Landlords must rely on insurance and regular inspections to manage risk.

Is pet damage considered intentional or accidental?

Is pet damage considered intentional or accidental?

Most insurers classify one-off events (like a dog running through a door) as accidental. However, recurring damage (like scratching a door frame over months) or hygiene issues (urine stains) are often classified as gradual damage or wear and tear, which is typically excluded from cover.

Who pays for carpet cleaning if I have a pet in a rental?

Who pays for carpet cleaning if I have a pet in a rental?

Landlords cannot automatically require professional carpet cleaning at the end of a tenancy. However, tenants are required to leave the property reasonably clean. If the pet has soiled the carpet beyond normal wear and tear, the tenant is responsible for the cleaning costs to restore it.

Can a landlord refuse pets in NZ?

Can a landlord refuse pets in NZ?

Yes, landlords can currently state ‘no pets’ in the tenancy agreement. However, if a tenant asks to get a pet later, the landlord must not unreasonably withhold consent, though they can impose reasonable conditions. Total bans are becoming harder to enforce without good reason.

How can tenants convince landlords to allow pets?

How can tenants convince landlords to allow pets?

Tenants can provide a ‘Pet CV’ with references, proof of training, and vaccination records. Additionally, showing proof of personal liability insurance (contents insurance) can reassure landlords that the tenant can cover accidental damage costs up to the liability cap.